On Monday, Dec. 18, the Cape Girardeau City Council will decide whether or not to put a new tax initiative on the April 2, 2024 ballot. This initiative will propose raising the city's combined property tax rate (personal and real estate) by $0.25 per $100 in assessed value. This generated increase would be directed entirely toward the salaries and benefits of city police officers and firefighters. There will be much discussion over the months ahead on the pros and cons of this issue, should it be put on the April ballot, but I'd like to explain here the city government's rationale for putting this initiative to the voters.

Funding issues

The City of Cape Girardeau uses city sales tax receipts for its General Fund, which is used to pay the salaries and benefits of city employees. The city's General Fund is not increasing at a rate that will fund significant increases to the salaries of our public safety officers. Measures have been taken recently to attempt to rectify this.

In 2014, the voter-approved Fire Safety Sales Tax was added to the city's sales tax. This tax funds equipment and facilities in our Police and Fire Departments. Please go to cityofcape.org/taxes to see more on city taxes.

In 2020, Cape Girardeau County put up a sales tax measure to fund Cape County and Sheriff's Department public safety expenses, which was approved in a countywide vote. Neither the City of Cape Girardeau nor its Police Department receives any revenue from this county sales tax, which is applied to all sales within Cape County.

In 2022:

- A new salary schedule was implemented to include step increases commensurate with public safety officers' earlier retirement.

- Three-year sign-on stipends were implemented to new recruits.

- End-of-year allocations of $1,000 were given to all full-time employees as preservation pay.

- $4.4 million from the city's federal ARPA funding and several other funds was used to upgrade retirement benefits to the highest level possible.

- Also from the ARPA funding, $91,000 was used for public safety forces health and wellness programs, and $178,000 in ShotSpotter technology to aid in officer engagement.

- The voter-approved use tax, which applies city sales tax to online purchases, increased the city's ability to pay employees by adding revenue to the General Fund. This tax has already proven essential in helping fund more-competitive salaries to city employees working not only in public safety, but also trash collection, street repair, water and sewer maintenance, and park maintenance and programming, just to name a few. Without these roles filled, essential services across all departments would be impaired.

- Wages for all city full-time employees were raised 11.7% in the FY23 pay plan.

In 2023:

- Additional ShotSpotter investments were made, in addition to new license plate reader technology that aids in criminal interventions.

- The voter-approved marijuana tax, which adds a 3% sales tax to marijuana purchases, also included a provision that up to 25% of receipts can be used by the Police Department in mental health and substance abuse issues it encounters daily with the public.

- $1,000 preservation pay continued.

- The budget included nearly $60,000 to address health and wellness support for our public safety employees.

- In the FY2024 budget, full-time wages of all employees were increased 3%. The FY 2024 salary plan has an annual starting pay for police officers and firefighters of $44,512.

Recruiting and retaining public safety officers is increasingly competitive, in a time when fewer people are going into these professions. In addition, the city needs to strategize on specific funding policies for public safety officers. These are our most expensive employees for very good reasons. They require extensive professional training, higher workers' compensation costs, and expensive technology and equipment -- all because of the dangerous, exhausting, and service-focused nature of their jobs. Public safety is the largest expense in the city's General Fund, and it will take a dedicated effort to significantly impact additional funding.

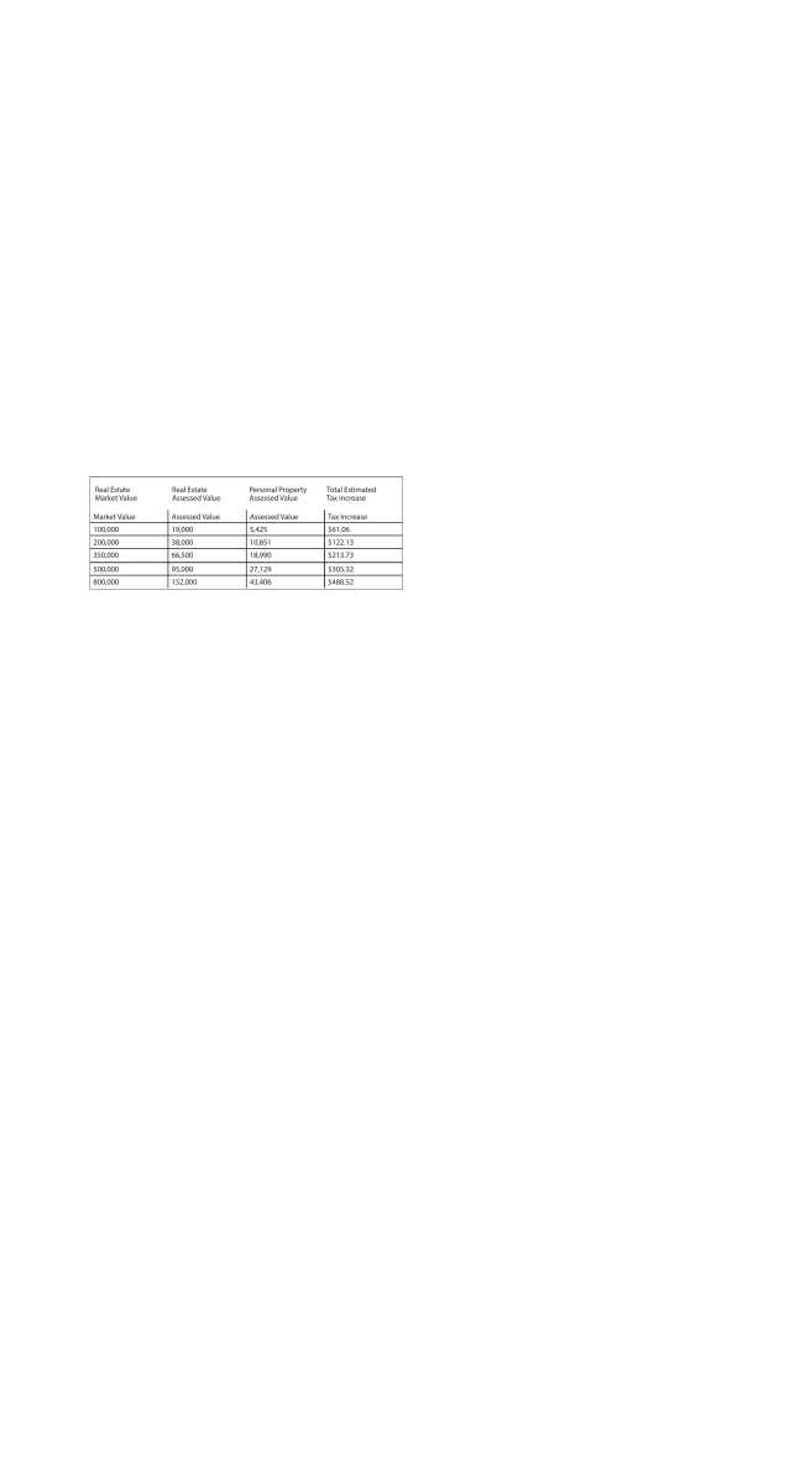

Personal and real estate property taxes in Cape

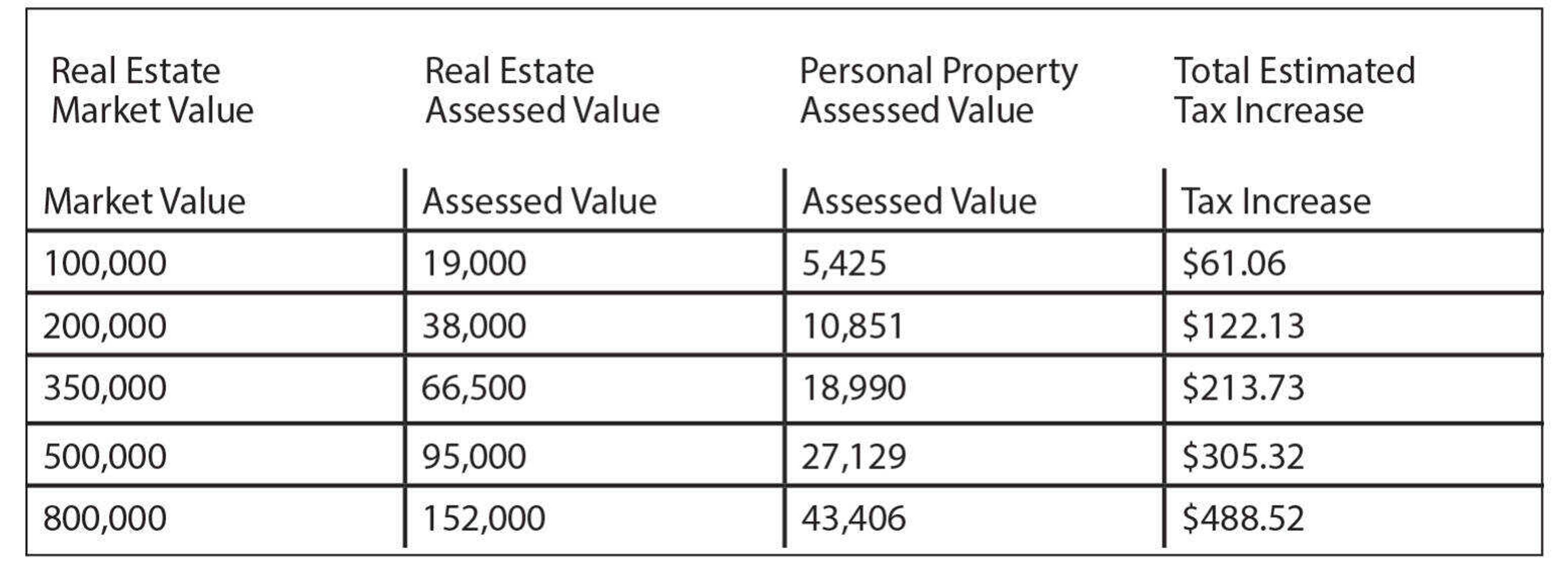

The proposed increase of $0.25 per $100 in assessed value of real estate and personal property is in addition to the current General Revenue Fund Tax of $0.3042 for the City of Cape Girardeau. The table nearby represents examples of estimated tax increases to individual bills.

Below are the 2022 general revenue property tax rates of other cities, published by the state, in our region (not all 2023 rates have been posted yet):

Jackson: $0.5906

Scott City: $0.532

Sikeston: $0.416

Perryville: $0.3696

Cape: $0.3057

Below are other similarly sized Missouri cities or hubs:

Wentzville: $0.5843

Jefferson City: $0.4698

University City: $0.448

Columbia : $0.4032

Cape: $0.3057

For 2023, the Cape Girardeau city general revenue levy dropped to $0.3042. The state's 2023 data report is anticipated soon.

Rationale

To raise the salaries and benefits of our public safety officers by 8% in the coming year, the city will need an estimated minimum amount of $1 million in additional annual income. These numbers have been tested by our administration over the past year, and there is no other funding source that can meet this need long term.

Some will rightly ask if the city can find that funding within the current budget. The response is that we could do so, but only through very sharp cuts in the Parks and Rec, Public Works, and/or Airport budgets -- specifically in personnel. As we have dealt with, and continue to deal with, employee shortages and cost increases in those departments, the city does not see this as a realistic way to increase the salaries of our public safety personnel, while also maintaining essential services throughout the city. These services are wide-ranging, from sanitation collection to street repair and park maintenance.

Some continue to assert that the city's Casino Fund should be used for this funding. We in the city will continue to reply that the Casino Fund is not an appropriate source of funding for the salaries and benefits of our employees.

With the existence of the Casino Fund, we have greatly appreciated the ability to fund some additional annual expenses and special projects, especially in the downtown area. However, using the proceeds from a singular private business for salaries is not sound financial practice for any municipality, and our annual audits would indicate as much if we began to do so. As the city works to recruit and retain our employees, our department directors and chiefs must confidently assure them that projected salaries, step increases, and career paths will be accurate five, 10 or even 30 years in the future.

I will also stress that the city is not proposing this tax rate increase because our current tax rate is thought to simply be "too low." The challenge the city faces is to better pay our public safety forces in a competitive and sustainable way, and this proposed tax increase is seen by our city administration and department chiefs as the best way to do that. It is targeted, stable and sustainable.

For all these reasons, the City of Cape is putting forth the idea of a general revenue property tax levy increase dedicated completely to police officer and firefighter compensation. Should the ballot measure be put forth, It is most appropriate that the citizens get to decide if this plan is of benefit to themselves and to our community at large.

Stacy Kinder is the mayor of the City of Cape Girardeau.